Blog

Understanding Time Series Forecasting

Time series forecasting is a powerful technique that allows analysts to make predictions about future events based on historical data. It’s particularly valuable across various sectors, from finance to retail, where understanding trends over time can influence decisions and strategize effectively.

What Is Time Series Data?

Before diving into forecasting methods, it’s essential to understand what constitutes time series data. At its core, time series data is a sequence of observations recorded over time. Each observation is typically timestamped, enabling a chronological order that helps identify trends, seasonal patterns, and cyclical fluctuations.

Key Characteristics of Time Series Data

- Trend: A long-term movement in the data, which can be upward, downward, or flat.

- Seasonality: Regular fluctuations that occur at specific intervals, often influenced by seasonal factors like weather or holidays.

- Cyclical Patterns: These are long-term fluctuations that may not follow a fixed period, usually linked to economic or business cycles.

- Irregular Variations: Unpredictable changes that can be caused by rare events, such as natural disasters or major economic changes.

Time Series Forecasting Techniques

There are various methods for forecasting time series data, each with its strengths and weaknesses. Below, we explore some of the most popular approaches, ranging from simple to complex.

1. Naive Forecasting

The naive method operates on the principle that future values are essentially the same as the most recent observations. This straightforward approach works well for stable data without significant trends or seasonality.

Pros:

- Easy to implement.

- Fast to compute.

Cons:

- Can be inaccurate for data exhibiting underlying patterns.

2. Moving Averages

Moving averages help smooth out fluctuations in the data, providing a clearer view of the trend. This method averages a fixed number of previous observations to predict future values.

Pros:

- Reduces noise in the data.

- Adapts well to trends.

Cons:

- Can lag behind actual changes in the trend.

3. Exponential Smoothing

This technique assigns exponentially decreasing weights to past observations, allowing more recent data to have a more significant impact on forecasting. It’s particularly useful when dealing with seasonal data.

Pros:

- More responsive to recent changes.

- Flexible with different seasonal patterns.

Cons:

- Requires careful selection of parameters.

4. ARIMA Models

The AutoRegressive Integrated Moving Average (ARIMA) model combines autoregression and moving averages, making it suitable for data exhibiting trends but without seasonal effects.

Pros:

- Effective for non-stationary data.

- Comprehensive model suitable for complex datasets.

Cons:

- Requires statistical expertise to implement correctly.

5. Seasonal Decomposition of Time Series (STL)

STL is a versatile method that separates time series data into trend, seasonal, and residual components. This approach facilitates more tailored models by addressing each component individually.

Pros:

- Flexible, accommodating various seasonal patterns.

- Allows for detailed analysis of each component.

Cons:

- Can be computationally intensive.

Selecting the Right Model

Choosing the appropriate forecasting model is crucial. The decision often depends on the specific characteristics of your data, the computational resources available, and the desired accuracy. Here are a few guiding principles:

-

Assess Data Characteristics: Understanding your data is the first step. Analyze trends, seasonality, and irregular fluctuations.

-

Start Simple: Use simpler models as baselines for comparison. Naive forecasting or moving averages can serve as a foundation.

-

Iterate and Validate: Test multiple models, validating their performance using historical data. Cross-validation techniques can help determine which model offers the best accuracy.

- Monitor Performance: Continuously assess the model’s performance over time. Adjust your methods based on changing patterns in your data.

Practical Applications of Time Series Forecasting

Time series forecasting finds applications in numerous fields, each leveraging these techniques to derive insights and inform strategy.

1. Financial Markets

In finance, investors use time series forecasting to predict stock prices, enabling more informed trading decisions. Assessing historical price movements can hint at future behavior.

2. Retail

Retailers often forecast demand for products based on past sales data. Understanding seasonal trends helps optimize inventory management and staffing.

3. Manufacturing

Manufacturers utilize forecasting to plan production schedules and manage supply chains. Accurate predictions assist in avoiding overproduction and minimizing wastage.

4. Weather Forecasting

Meteorologists apply time series forecasting techniques to predict weather patterns. Combining historic weather data aids in achieving better accuracy in forecasts.

Best Practices for Effective Forecasting

To harness the full potential of time series forecasting, consider the following best practices:

1. Data Quality

Ensure high-quality data is used in your analyses. Missing values, outliers, and inaccuracies can significantly skew results. Employ techniques to clean and preprocess data for better outcomes.

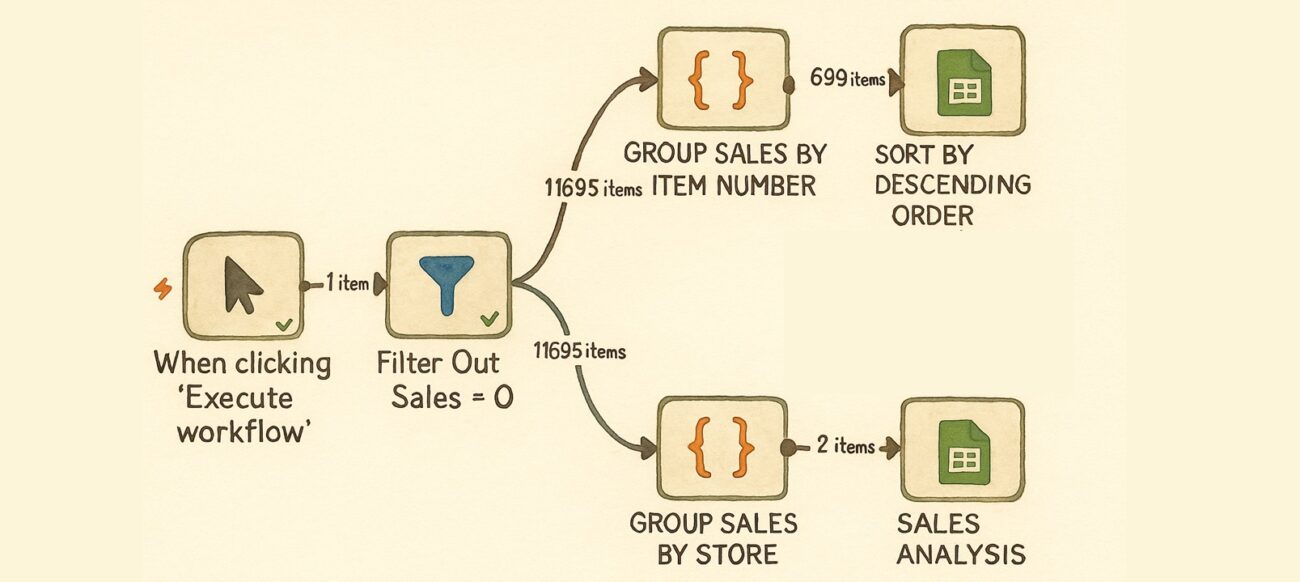

2. Leverage Automation

Utilize software tools and programming languages such as Python or R to automate the forecasting process. Libraries like statsmodels and Prophet provide robust frameworks for implementing various forecasting models.

3. Stay Updated

The field of data science evolves rapidly. Regularly update your knowledge on the latest techniques, tools, and best practices in time series forecasting through online courses and resources.

4. Collaborate Cross-Functionally

Work alongside subject matter experts in your domain to enhance the insights derived from your forecasts. Collaborating with stakeholders can provide context that improves the relevance of your predictions.

Conclusion

Time series forecasting is a crucial domain in data science, with vast applications across industries. By understanding the various methods available and adhering to best practices, you can enhance your predictive analytics capabilities. Whether you’re a seasoned data scientist or just beginning, leveraging these techniques will empower you to make informed, data-driven decisions that can significantly impact your organization’s future.

Elementor Pro

In stock

PixelYourSite Pro

In stock

Rank Math Pro

In stock

Related posts

WooCommerce Floating Cart Plugin | Modern Cart #woocommerce #wordpress

How to Create a Website with MilesWeb’s WordPress AI Website Builder

Google Store Widget Program: Complete 3-Tier Guide for Trust & Sales

How to Reduce KV Cache Bottlenecks with NVIDIA Dynamo

Shopify vs WordPress (2025) — Which is Better?

新手零基础用10Web AI快速搭建WordPress网站!10Web AI建站工具全教程|教你如何克隆复制任何网站做成自己的网页

Hack Club Accuses Slack of Extortionate Pricing in $190K Hike

From Python to JavaScript: A Playbook for Data Analytics in n8n with Code Node Examples

Liquid Glass Design and Advanced AI Enhancements

A pivotal meeting on vaccine guidance is underway—and former CDC leaders are alarmed

Review of GoDaddy WordPress Hosting – The Shocking Truth You NEED to Know Before Buying!

Estela Rueda on revolutionizing WordPress docs with AI

Products

-

Rayzi : Live streaming, PK Battel, Multi Live, Voice Chat Room, Beauty Filter with Admin Panel

Rayzi : Live streaming, PK Battel, Multi Live, Voice Chat Room, Beauty Filter with Admin Panel

$98.40Original price was: $98.40.$34.44Current price is: $34.44.In stock

-

Team Showcase – WordPress Plugin

Team Showcase – WordPress Plugin

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

ChatBot for WooCommerce – Retargeting, Exit Intent, Abandoned Cart, Facebook Live Chat – WoowBot

ChatBot for WooCommerce – Retargeting, Exit Intent, Abandoned Cart, Facebook Live Chat – WoowBot

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

FOX – Currency Switcher Professional for WooCommerce

FOX – Currency Switcher Professional for WooCommerce

$41.00Original price was: $41.00.$4.02Current price is: $4.02.In stock

-

WooCommerce Attach Me!

WooCommerce Attach Me!

$41.00Original price was: $41.00.$4.02Current price is: $4.02.In stock

-

Magic Post Thumbnail Pro

Magic Post Thumbnail Pro

$53.71Original price was: $53.71.$3.69Current price is: $3.69.In stock

-

Bus Ticket Booking with Seat Reservation PRO

Bus Ticket Booking with Seat Reservation PRO

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

GiveWP + Addons

GiveWP + Addons

$53.71Original price was: $53.71.$3.85Current price is: $3.85.In stock

-

ACF Views Pro

ACF Views Pro

$62.73Original price was: $62.73.$3.94Current price is: $3.94.In stock

-

Kadence Theme Pro

Kadence Theme Pro

$53.71Original price was: $53.71.$3.69Current price is: $3.69.In stock

-

LoginPress Pro

LoginPress Pro

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

ElementsKit – Addons for Elementor

ElementsKit – Addons for Elementor

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

CartBounty Pro – Save and recover abandoned carts for WooCommerce

CartBounty Pro – Save and recover abandoned carts for WooCommerce

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

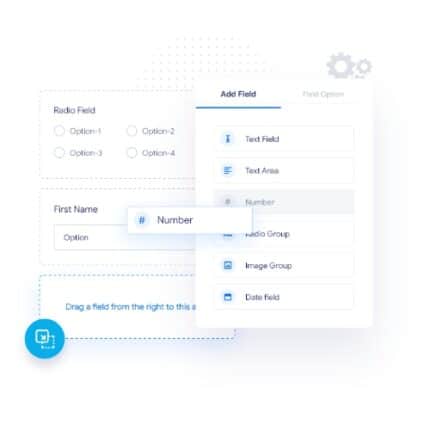

Checkout Field Editor and Manager for WooCommerce Pro

Checkout Field Editor and Manager for WooCommerce Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Social Auto Poster

Social Auto Poster

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Vitepos Pro

Vitepos Pro

$53.71Original price was: $53.71.$12.30Current price is: $12.30.In stock

-

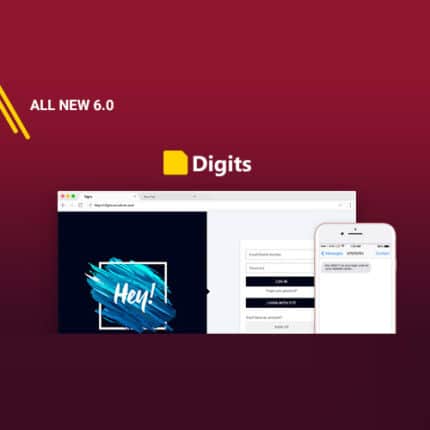

Digits : WordPress Mobile Number Signup and Login

Digits : WordPress Mobile Number Signup and Login

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

JetEngine For Elementor

JetEngine For Elementor

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

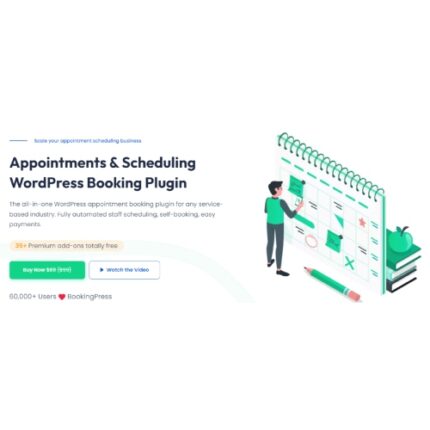

BookingPress Pro – Appointment Booking plugin

BookingPress Pro – Appointment Booking plugin

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Polylang Pro

Polylang Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

All-in-One WP Migration Unlimited Extension

All-in-One WP Migration Unlimited Extension

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Slider Revolution Responsive WordPress Plugin

Slider Revolution Responsive WordPress Plugin

$53.71Original price was: $53.71.$4.51Current price is: $4.51.In stock

-

Advanced Custom Fields (ACF) Pro

Advanced Custom Fields (ACF) Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Gillion | Multi-Concept Blog/Magazine & Shop WordPress AMP Theme

Rated 4.60 out of 5

Gillion | Multi-Concept Blog/Magazine & Shop WordPress AMP Theme

Rated 4.60 out of 5$53.71Original price was: $53.71.$5.00Current price is: $5.00.In stock

-

Eidmart | Digital Marketplace WordPress Theme

Rated 4.70 out of 5

Eidmart | Digital Marketplace WordPress Theme

Rated 4.70 out of 5$53.71Original price was: $53.71.$5.00Current price is: $5.00.In stock

-

Phox - Hosting WordPress & WHMCS Theme

Rated 4.89 out of 5

Phox - Hosting WordPress & WHMCS Theme

Rated 4.89 out of 5$53.71Original price was: $53.71.$5.17Current price is: $5.17.In stock

-

Cuinare - Multivendor Restaurant WordPress Theme

Rated 4.14 out of 5

Cuinare - Multivendor Restaurant WordPress Theme

Rated 4.14 out of 5$53.71Original price was: $53.71.$5.17Current price is: $5.17.In stock

-

Eikra - Education WordPress Theme

Rated 4.60 out of 5

Eikra - Education WordPress Theme

Rated 4.60 out of 5$62.73Original price was: $62.73.$5.08Current price is: $5.08.In stock

-

Tripgo - Tour Booking WordPress Theme

Rated 5.00 out of 5

Tripgo - Tour Booking WordPress Theme

Rated 5.00 out of 5$53.71Original price was: $53.71.$4.76Current price is: $4.76.In stock

-

Subhan - Personal Portfolio/CV WordPress Theme

Rated 4.89 out of 5

Subhan - Personal Portfolio/CV WordPress Theme

Rated 4.89 out of 5$53.71Original price was: $53.71.$4.76Current price is: $4.76.In stock