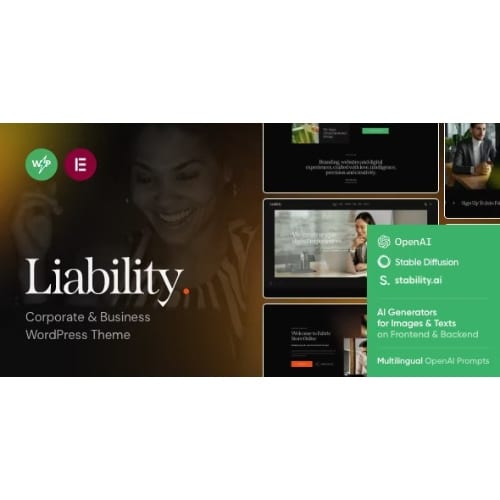

Liability | Insurance & Finance WordPress Theme

✅ Include Licence Certificate

✅ Future Official updates

✅ Auto Updates In WordPress Dashboard

✅ 100% Original Lisence Key

✅ 24/7 Extend support

✅ Great Savings Money.

✅ Latest Version Guarantee

✅ 1 domain will be activated.

✅No Crack, No GPL, No Null, 100 % Original Product

৳ 6,550 Original price was: ৳ 6,550.৳ 580Current price is: ৳ 580.

-

৳ BDT

-

$ USD

In stock

Payment Methods:

Description

Liability insurance is an essential safeguard for individuals and businesses alike, providing financial protection against claims resulting from injuries and damage to people or property. This type of insurance is designed to cover legal costs and payouts for which the insured party would be found liable. Whether you are a small business owner, a freelancer, or an individual seeking peace of mind, liability insurance is a crucial component of risk management.

In today’s litigious society, the importance of liability insurance cannot be overstated. Accidents can happen at any time, and the financial repercussions can be devastating. Liability insurance helps mitigate these risks by covering legal fees, medical expenses, and damages awarded in lawsuits. This protection allows you to focus on your work and personal life without the constant worry of potential legal issues.

For businesses, liability insurance is not just a safety net; it is often a requirement for operating legally. Many clients and partners will require proof of liability insurance before entering into contracts or agreements. This coverage not only protects your business assets but also enhances your credibility and professionalism in the eyes of clients and stakeholders.

There are various types of liability insurance available, each tailored to meet specific needs. General liability insurance is the most common type, covering a wide range of incidents, including bodily injury, property damage, and personal injury claims. Professional liability insurance, also known as errors and omissions insurance, is designed for professionals who provide services or advice, protecting them against claims of negligence or inadequate work.

Another important type is product liability insurance, which is essential for manufacturers and retailers. This coverage protects against claims arising from injuries or damages caused by products sold or manufactured by the business. In an age where consumer safety is paramount, having product liability insurance can safeguard your business from costly lawsuits and reputational damage.

For individuals, personal liability insurance is often included in homeowners or renters insurance policies. This coverage protects against claims resulting from accidents that occur on your property or as a result of your actions. It is particularly important for homeowners, as it can cover legal fees and damages if someone is injured on your property.

When selecting liability insurance, it is crucial to assess your specific needs and risks. Consider factors such as the nature of your business, the services you provide, and the potential risks associated with your activities. Consulting with an insurance professional can help you navigate the complexities of liability insurance and ensure you have the appropriate coverage in place.

In addition to providing financial protection, liability insurance can also offer peace of mind. Knowing that you are covered in the event of an unexpected incident allows you to operate with confidence. This is especially important for entrepreneurs and small business owners who may not have the financial resources to absorb the costs of a lawsuit.

Moreover, liability insurance can be a valuable asset in negotiations and contracts. Having adequate coverage can strengthen your position when discussing terms with clients, suppliers, or partners. It demonstrates that you are responsible and prepared for potential risks, which can lead to more favorable business relationships.

In conclusion, liability insurance is a vital component of risk management for both individuals and businesses. It provides essential financial protection against claims and lawsuits, allowing you to focus on your work and personal life without the constant fear of legal repercussions. With various types of liability insurance available, it is important to assess your specific needs and consult with an insurance professional to ensure you have the right coverage in place. Investing in liability insurance is not just a smart business decision; it is a necessary step in safeguarding your future.

Customer Reviews

3 reviews for Liability | Insurance & Finance WordPress Theme

Clear filtersOnly logged in customers who have purchased this product may leave a review.

Related Products

Avada | Website Builder For WordPress & WooCommerce

In stock

Clotya – Fashion Store eCommerce Theme

In stock

Jannah Newspaper Magazine News BuddyPress AMP

In stock

Komo – Bike Rental Shop WordPress Theme

In stock

Newspaper News & WooCommerce WordPress Theme

In stock

Residence Real Estate WordPress Theme

In stock

Darius Ford (verified owner) –

Very fast and efficient theme

Everett Malone (verified owner) –

Highly reliable

Elijah Sullivan (verified owner) –

Very easy to use and configure