Blog

In a world increasingly driven by technological innovation, Oracle’s recent financial surge illustrates the profound impact of artificial intelligence on market dynamics. This impressive 36% increase in Oracle’s shares, resulting in a whopping $244 billion boost in its market capitalization, highlights a significant turning point for the company. This blog post will explore the factors behind Oracle’s surge, the implications for investors, and what this means for the future of AI in the tech industry.

Understanding the Surge: Why Did Oracle’s Shares Skyrocket?

The sudden spike in Oracle’s stock can be attributed to several key factors that align it strategically within the expanding AI landscape.

1. Increased Demand for AI Solutions

As businesses of all sizes begin to recognize the transformative potential of artificial intelligence, the demand for AI-driven solutions has skyrocketed. Oracle has positioned itself as a leader in this field, offering a comprehensive suite of products designed to help companies harness AI effectively.

- Cloud Services: Oracle’s cloud computing services have evolved to incorporate AI capabilities, allowing businesses to run more efficient operations.

- Data Management: Their focus on robust data management tools enhances businesses’ ability to analyze and utilize data effectively.

2. Strategic Partnerships and Acquisitions

Oracle’s growth strategy has heavily relied on forming strategic partnerships and acquisitions. By collaborating with innovative tech companies, Oracle amplifies its AI capabilities and market reach.

- Notable Acquisitions: Recent acquisitions of AI startups have bolstered its technology stack, providing customers with cutting-edge solutions.

- Partnerships with Tech Giants: Collaborating with established tech companies has expanded Oracle’s ecosystem, ensuring its offerings remain competitive.

Implications for Investors

The surge in Oracle’s stock value raises essential considerations for investors seeking to navigate the tech landscape.

1. Evaluating Market Trends

Investors should remain vigilant regarding trends in AI and cloud computing. Understanding these trends can inform better investment decisions, particularly concerning tech stocks like Oracle.

- Market Research: Regularly engaging in market research can provide insights into potential growth sectors within the industry.

- Diversifying Investments: As industries evolve, diversifying a portfolio within tech stocks can mitigate risks associated with market volatility.

2. Monitoring Competition

Oracle’s impressive performance doesn’t occur in isolation. It’s crucial to monitor competitors in the AI and cloud sectors, as their innovations can impact Oracle’s position in the market.

- Competitor Analysis: Regularly analyzing competitor strategies helps investors gauge Oracle’s potential for sustained growth.

- Identifying Market Leaders: Keeping an eye on emerging market leaders allows investors to make informed predictions about market shifts.

The Future of AI in the Tech Industry

Oracle’s impressive growth is indicative of broader trends in the tech sector. As companies look to AI to drive efficiency and innovation, expectations for future advancements are sky-high.

1. Expanding AI Applications

AI’s applications are proliferating across various industries, from healthcare to finance, further driving demand for robust solutions:

- Healthcare Improvements: AI facilitates improved patient outcomes through data analytics and predictive modeling.

- Financial Services: Automation in banking processes can lead to safer and more efficient transactions.

2. Continuous Innovation

To stay relevant in a rapidly evolving landscape, technology companies, including Oracle, must prioritize continuous innovation. This requires:

- Investment in Research: Allocating resources to R&D can lead to breakthrough innovations.

- Feedback Loops: Engaging with customers to gather feedback can direct product enhancements.

FAQs About Oracle’s Recent Growth

Q1: What does Oracle’s surge mean for the future of AI?

Oracle’s growth signifies increasing reliance on AI technologies across various sectors, suggesting a sustained demand for AI solutions.

Q2: Should I invest in Oracle now?

Consider your investment strategy; while Oracle’s growth is promising, evaluate market conditions and consult a financial advisor.

Q3: How is Oracle planning to sustain this growth?

By focusing on innovation and strategic partnerships, Oracle aims to maintain its competitive edge in the AI market.

Conclusion

Oracle’s recent stock surge is not just a reflection of its current success but also a harbinger of the possibilities ahead in the tech industry. As businesses increasingly turn to AI for transformation, Oracle stands poised to lead the charge. Investors who pay close attention to market trends, competitive dynamics, and Oracle’s strategic initiatives will be well-equipped to make informed decisions in this fast-paced environment.

For further insights on technology trends and investment strategies, consider exploring articles on Theme Bazar.

By keeping abreast of these developments, you can navigate the complexities of the tech market more effectively, ensuring your portfolio is aligned with the future of innovation.

Elementor Pro

In stock

PixelYourSite Pro

In stock

Rank Math Pro

In stock

Related posts

Build a Report Generator AI Agent with NVIDIA Nemotron on OpenRouter

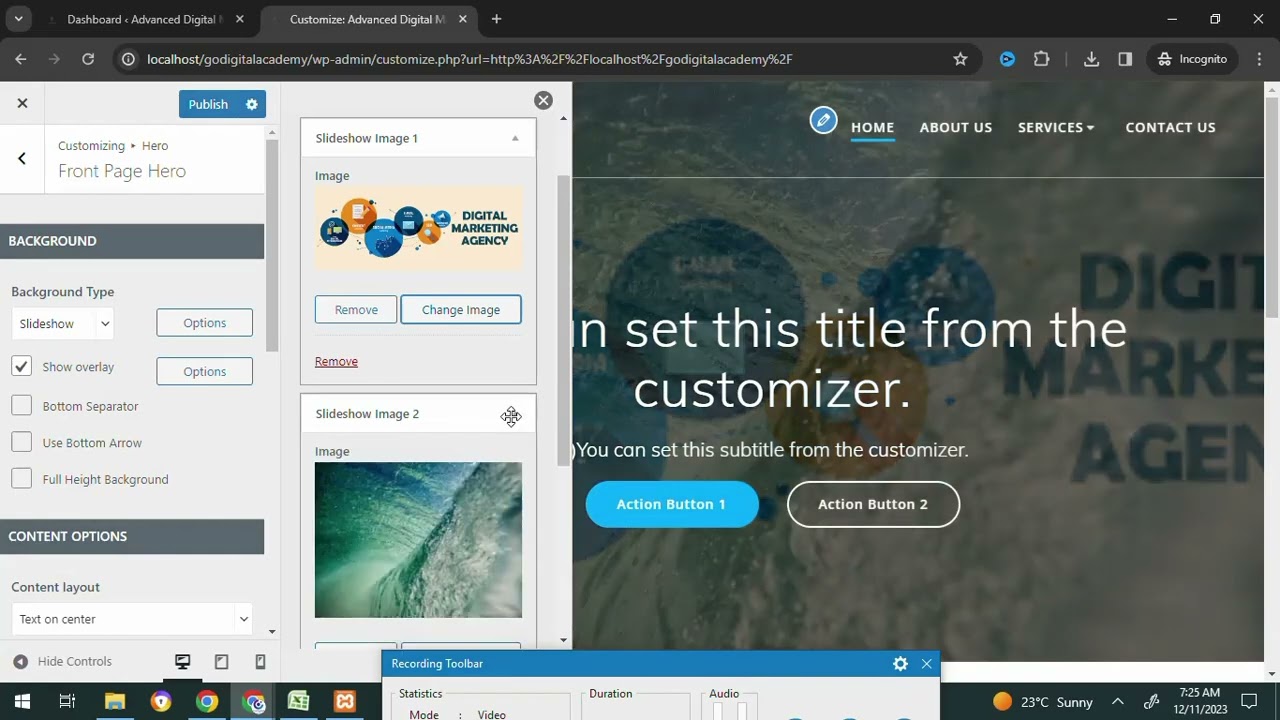

Word Press Day-3 How to add the Slideshow images and Top Bar and Editing the Home Page #godigital

Oracle Shares Surge 36% on AI Demand, Adding $244B Market Value

Top 5 AI Plugins That Will Change WordPress in 2025! 🚀 #websitesetup #websitedomain

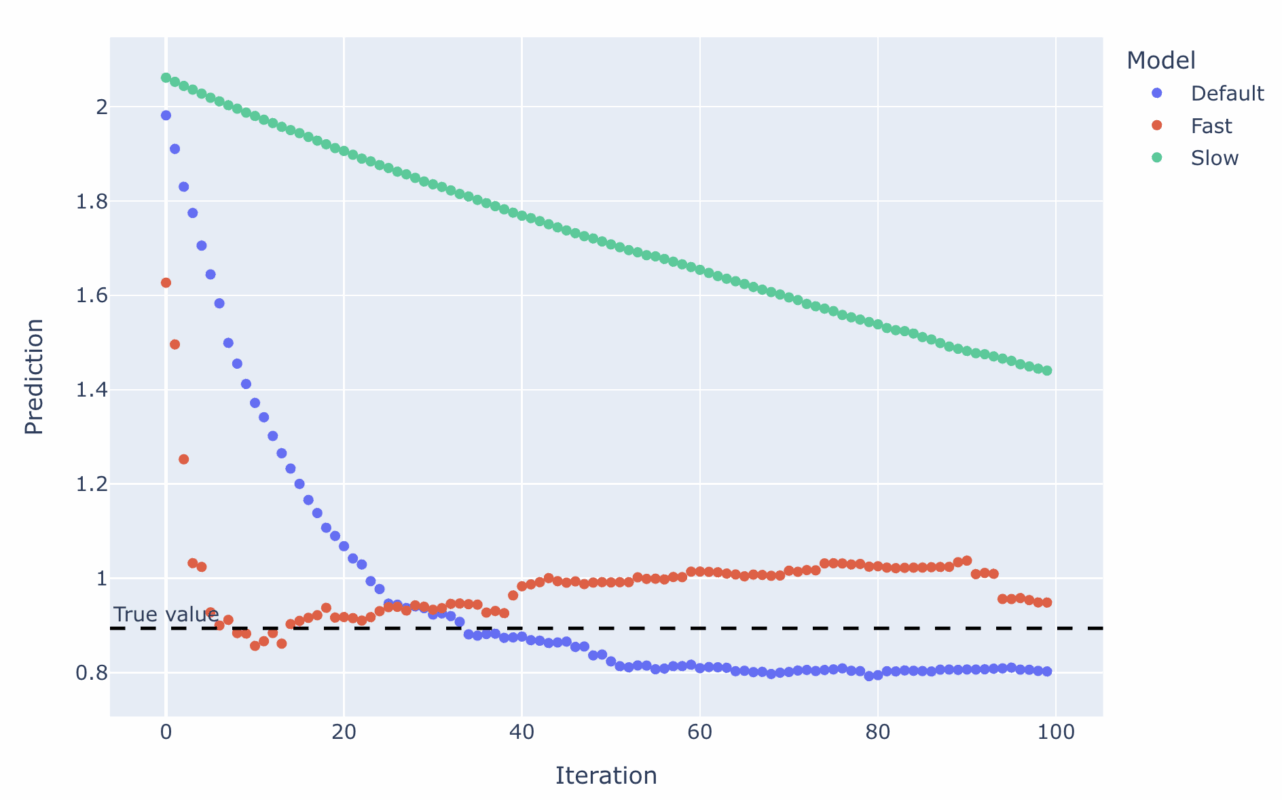

A Visual Guide to Tuning Gradient Boosted Trees

Here’s How I Built an MCP to Automate My Data Science Job

🔐Miss Genève 🌩️🌝🦅 ⚕️📿Wix and Word Press. Ads, Websites Developer. Marketers, Marketing experts,

AI Engine: o Melhor Plugin de Inteligência Artificial Grátis para WordPress – ChatGPT – OpenAI

AT&T Scales Back Office Surveillance After Employee Frustration

You Only Need 3 Things to Turn AI Experiments into AI Advantage

Gohighlevel’s mega menu feature breakdown in 3 minutes

Trump’s 2025 Bill Delivers $40B Boost to Fossil Fuel Industry

Products

-

Rayzi : Live streaming, PK Battel, Multi Live, Voice Chat Room, Beauty Filter with Admin Panel

Rayzi : Live streaming, PK Battel, Multi Live, Voice Chat Room, Beauty Filter with Admin Panel

$98.40Original price was: $98.40.$34.44Current price is: $34.44.In stock

-

Team Showcase – WordPress Plugin

Team Showcase – WordPress Plugin

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

ChatBot for WooCommerce – Retargeting, Exit Intent, Abandoned Cart, Facebook Live Chat – WoowBot

ChatBot for WooCommerce – Retargeting, Exit Intent, Abandoned Cart, Facebook Live Chat – WoowBot

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

FOX – Currency Switcher Professional for WooCommerce

FOX – Currency Switcher Professional for WooCommerce

$41.00Original price was: $41.00.$4.02Current price is: $4.02.In stock

-

WooCommerce Attach Me!

WooCommerce Attach Me!

$41.00Original price was: $41.00.$4.02Current price is: $4.02.In stock

-

Magic Post Thumbnail Pro

Magic Post Thumbnail Pro

$53.71Original price was: $53.71.$3.69Current price is: $3.69.In stock

-

Bus Ticket Booking with Seat Reservation PRO

Bus Ticket Booking with Seat Reservation PRO

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

GiveWP + Addons

GiveWP + Addons

$53.71Original price was: $53.71.$3.85Current price is: $3.85.In stock

-

ACF Views Pro

ACF Views Pro

$62.73Original price was: $62.73.$3.94Current price is: $3.94.In stock

-

Kadence Theme Pro

Kadence Theme Pro

$53.71Original price was: $53.71.$3.69Current price is: $3.69.In stock

-

LoginPress Pro

LoginPress Pro

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

ElementsKit – Addons for Elementor

ElementsKit – Addons for Elementor

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

CartBounty Pro – Save and recover abandoned carts for WooCommerce

CartBounty Pro – Save and recover abandoned carts for WooCommerce

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

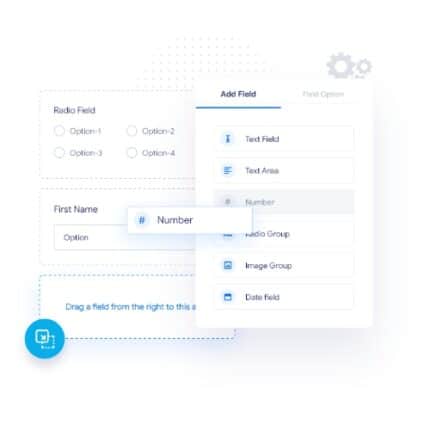

Checkout Field Editor and Manager for WooCommerce Pro

Checkout Field Editor and Manager for WooCommerce Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Social Auto Poster

Social Auto Poster

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Vitepos Pro

Vitepos Pro

$53.71Original price was: $53.71.$12.30Current price is: $12.30.In stock

-

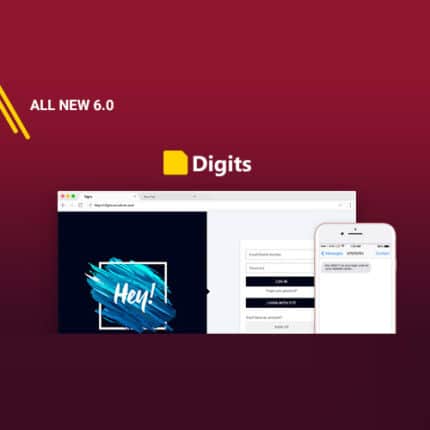

Digits : WordPress Mobile Number Signup and Login

Digits : WordPress Mobile Number Signup and Login

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

JetEngine For Elementor

JetEngine For Elementor

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

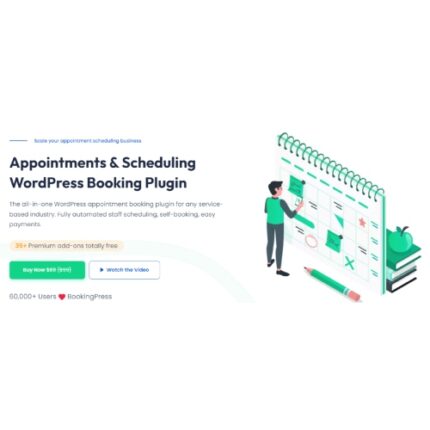

BookingPress Pro – Appointment Booking plugin

BookingPress Pro – Appointment Booking plugin

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Polylang Pro

Polylang Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

All-in-One WP Migration Unlimited Extension

All-in-One WP Migration Unlimited Extension

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Slider Revolution Responsive WordPress Plugin

Slider Revolution Responsive WordPress Plugin

$53.71Original price was: $53.71.$4.51Current price is: $4.51.In stock

-

Advanced Custom Fields (ACF) Pro

Advanced Custom Fields (ACF) Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Gillion | Multi-Concept Blog/Magazine & Shop WordPress AMP Theme

Rated 4.60 out of 5

Gillion | Multi-Concept Blog/Magazine & Shop WordPress AMP Theme

Rated 4.60 out of 5$53.71Original price was: $53.71.$5.00Current price is: $5.00.In stock

-

Eidmart | Digital Marketplace WordPress Theme

Rated 4.70 out of 5

Eidmart | Digital Marketplace WordPress Theme

Rated 4.70 out of 5$53.71Original price was: $53.71.$5.00Current price is: $5.00.In stock

-

Phox - Hosting WordPress & WHMCS Theme

Rated 4.89 out of 5

Phox - Hosting WordPress & WHMCS Theme

Rated 4.89 out of 5$53.71Original price was: $53.71.$5.17Current price is: $5.17.In stock

-

Cuinare - Multivendor Restaurant WordPress Theme

Rated 4.14 out of 5

Cuinare - Multivendor Restaurant WordPress Theme

Rated 4.14 out of 5$53.71Original price was: $53.71.$5.17Current price is: $5.17.In stock

-

Eikra - Education WordPress Theme

Rated 4.60 out of 5

Eikra - Education WordPress Theme

Rated 4.60 out of 5$62.73Original price was: $62.73.$5.08Current price is: $5.08.In stock

-

Tripgo - Tour Booking WordPress Theme

Rated 5.00 out of 5

Tripgo - Tour Booking WordPress Theme

Rated 5.00 out of 5$53.71Original price was: $53.71.$4.76Current price is: $4.76.In stock

-

Subhan - Personal Portfolio/CV WordPress Theme

Rated 4.89 out of 5

Subhan - Personal Portfolio/CV WordPress Theme

Rated 4.89 out of 5$53.71Original price was: $53.71.$4.76Current price is: $4.76.In stock