Blog

The financial landscape is constantly evolving, and recent developments indicate that the Federal Reserve is poised for a significant change. As labor market signs seem to weaken and inflation continues to pose challenges, a projected 25 basis points (BPS) rate cut could be on the horizon. This decision is not just a mere adjustment; it reflects broader economic trends that could impact individuals, businesses, and the overall economy.

Understanding the Current Economic Climate

Weakening Labor Market

Economic indicators suggest that the labor market is showing signs of strain. Job growth has slowed, and various sectors are facing challenges. A dwindling workforce participation rate and rising unemployment claims are raising concerns about consumer spending, which is crucial for economic health. Amid this backdrop, here’s why the Federal Reserve might consider a rate cut:

- Encouraging Borrowing and Spending: A lower interest rate often translates to cheaper loans, stimulating consumer spending and investment.

- Supporting Financial Stability: An easing of rates can help stabilize markets that may be reacting negatively to labor data.

Persistent Inflation Woes

Inflation has been a persistent issue, complicating the Fed’s decision-making process. Although some sectors report stabilizing prices, others continue to experience rising costs. Here are some reasons why inflation warrants careful attention:

- Rising Consumer Prices: Basic goods and services remain expensive, affecting household budgets.

- Supply Chain Disruptions: Continuing global disruptions influence both supply and demand dynamics, exacerbating inflation concerns.

By potentially reducing rates, the Federal Reserve aims to manage inflation while creating a more favorable environment for economic growth.

What a 25 BPS Rate Cut Means for You

Understanding the implications of a rate cut can prepare individuals and businesses for financial adjustments. Here’s how this decision might impact various stakeholders:

For Homebuyers and Homeowners

A 25 BPS cut in rates could provide immediate benefits for those looking to buy or refinance a home. Here’s how:

- Lower Mortgage Rates: Home buyers may have access to cheaper mortgage rates, making homeownership more attainable.

- Enhanced Refinancing Opportunities: Homeowners can benefit from better refinancing options, potentially lowering monthly payments and reducing overall debt.

For Investors

Investors should also consider how rate changes can affect their portfolios:

- Stock Market Response: Historically, lower interest rates can boost stock prices as companies benefit from cheaper borrowing costs.

- Bond Market Effects: Investors in bonds may see yields adjust, with lower rates often leading to higher bond prices.

For Small Business Owners

Small businesses frequently rely on loans for growth and expansion. Here’s what a rate cut means for them:

- Access to Capital: Cheaper loans can facilitate expansion and investment in new equipment or services.

- Enhanced Cash Flow Management: Lower interest payments can improve cash flow, allowing businesses to allocate resources more efficiently.

Addressing FAQs on Rate Cuts

Q: How often does the Federal Reserve adjust interest rates?

The Fed does not have a set schedule for rate adjustments, typically meeting every six weeks to evaluate the economy.

Q: What are the risks associated with a rate cut?

While lower rates stimulate growth, they can also lead to higher inflation if consumers begin overspending, which may make future adjustments more complicated.

Q: How do rate cuts impact savings accounts?

Rate cuts often lead to lower interest rates on savings accounts, which can reduce the returns for individuals relying on interest income.

Key Takeaways

- A potential 25 BPS rate cut from the Federal Reserve reflects ongoing economic challenges, particularly within the labor sector and inflation.

- Homebuyers, investors, and small business owners could all benefit from lower interest rates, enhancing financial opportunities.

- Staying informed on these adjustments will help individuals make better financial decisions moving forward.

For further insights into labor market trends and financial strategies, explore more here. As economic conditions continue to evolve, being proactive can position you and your business for success.

Conclusion

Navigating the complexities of the financial environment requires understanding the implications of decisions made by the Federal Reserve. A 25 BPS rate cut may serve as a necessary tool to stimulate growth amid challenges, providing opportunities for borrowers and investors alike. By staying informed and adaptable, you can leverage these changes to your advantage.

For more information, check out our detailed articles on related financial topics at Theme Bazar.

Elementor Pro

PixelYourSite Pro

Rank Math Pro

Related posts

Building a WordPress Plugin | Jon learns to code with AI

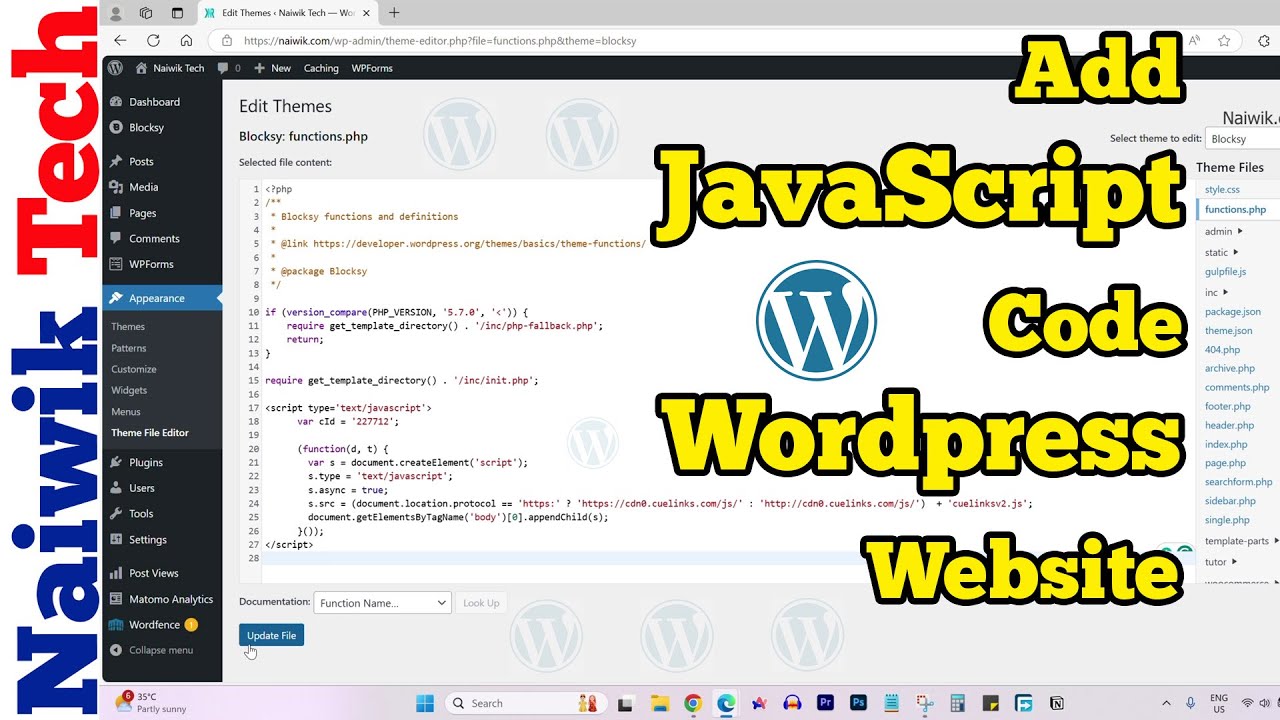

How to add custom Javascript code to WordPress website

6 Best FREE WordPress Contact Form Plugins In 2025!

Solve Puzzles to Silence Alarms and Boost Alertness

Conheça AI do WordPress para construção de sites

WordPress vs Shopify: The Ultimate Comparison for Online Store Owners | Shopify Tutorial

Apple Ends iCloud Support for iOS 10, macOS Sierra on Sept 15, 2025

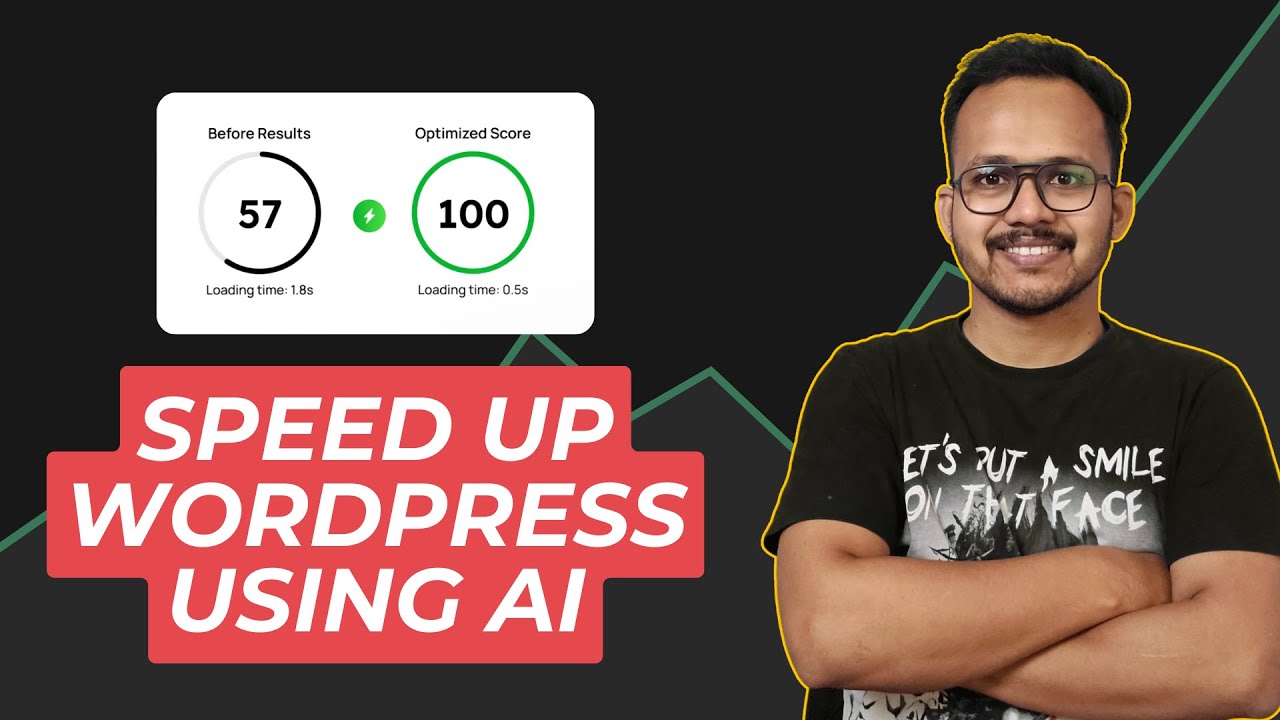

How to Speed up WordPress Website using AI 🔥(RapidLoad AI Plugin Review)

Bringing AI Agents Into Any UI: The AG-UI Protocol for Real-Time, Structured Agent–Frontend Streams

Web Hosting vs WordPress Web Hosting | The Difference May Break Your Site

Google Lays Off 200+ AI Contractors Amid Unionization Disputes

MIT’s LEGO: A Compiler for AI Chips that Auto-Generates Fast, Efficient Spatial Accelerators

Products

-

Rayzi : Live streaming, PK Battel, Multi Live, Voice Chat Room, Beauty Filter with Admin Panel

Rayzi : Live streaming, PK Battel, Multi Live, Voice Chat Room, Beauty Filter with Admin Panel

$98.40Original price was: $98.40.$34.44Current price is: $34.44. -

Team Showcase – WordPress Plugin

Team Showcase – WordPress Plugin

$53.71Original price was: $53.71.$4.02Current price is: $4.02. -

ChatBot for WooCommerce – Retargeting, Exit Intent, Abandoned Cart, Facebook Live Chat – WoowBot

ChatBot for WooCommerce – Retargeting, Exit Intent, Abandoned Cart, Facebook Live Chat – WoowBot

$53.71Original price was: $53.71.$4.02Current price is: $4.02. -

FOX – Currency Switcher Professional for WooCommerce

FOX – Currency Switcher Professional for WooCommerce

$41.00Original price was: $41.00.$4.02Current price is: $4.02. -

WooCommerce Attach Me!

WooCommerce Attach Me!

$41.00Original price was: $41.00.$4.02Current price is: $4.02. -

Ultimate Post Kit Pro

Ultimate Post Kit Pro

$53.71Original price was: $53.71.$3.69Current price is: $3.69. -

Magic Post Thumbnail Pro

Magic Post Thumbnail Pro

$53.71Original price was: $53.71.$3.69Current price is: $3.69. -

Bus Ticket Booking with Seat Reservation PRO

Bus Ticket Booking with Seat Reservation PRO

$53.71Original price was: $53.71.$4.02Current price is: $4.02. -

GiveWP + Addons

GiveWP + Addons

$53.71Original price was: $53.71.$3.85Current price is: $3.85. -

JetBlog – Blogging Package for Elementor Page Builder

JetBlog – Blogging Package for Elementor Page Builder

$53.71Original price was: $53.71.$4.02Current price is: $4.02. -

ACF Views Pro

ACF Views Pro

$62.73Original price was: $62.73.$3.94Current price is: $3.94. -

Kadence Theme Pro

Kadence Theme Pro

$53.71Original price was: $53.71.$3.69Current price is: $3.69. -

LoginPress Pro

LoginPress Pro

$53.71Original price was: $53.71.$4.02Current price is: $4.02. -

ElementsKit – Addons for Elementor

ElementsKit – Addons for Elementor

$53.71Original price was: $53.71.$4.02Current price is: $4.02. -

CartBounty Pro – Save and recover abandoned carts for WooCommerce

CartBounty Pro – Save and recover abandoned carts for WooCommerce

$53.71Original price was: $53.71.$3.94Current price is: $3.94. -

Checkout Field Editor and Manager for WooCommerce Pro

Checkout Field Editor and Manager for WooCommerce Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94. -

Social Auto Poster

Social Auto Poster

$53.71Original price was: $53.71.$3.94Current price is: $3.94. -

Vitepos Pro

Vitepos Pro

$53.71Original price was: $53.71.$12.30Current price is: $12.30. -

Digits : WordPress Mobile Number Signup and Login

Digits : WordPress Mobile Number Signup and Login

$53.71Original price was: $53.71.$3.94Current price is: $3.94. -

JetEngine For Elementor

JetEngine For Elementor

$53.71Original price was: $53.71.$3.94Current price is: $3.94. -

BookingPress Pro – Appointment Booking plugin

BookingPress Pro – Appointment Booking plugin

$53.71Original price was: $53.71.$3.94Current price is: $3.94. -

Polylang Pro

Polylang Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94. -

All-in-One WP Migration Unlimited Extension

All-in-One WP Migration Unlimited Extension

$53.71Original price was: $53.71.$3.94Current price is: $3.94. -

Essential Addons for Elementor – Pro

Essential Addons for Elementor – Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94. -

Slider Revolution Responsive WordPress Plugin

Slider Revolution Responsive WordPress Plugin

$53.71Original price was: $53.71.$4.51Current price is: $4.51. -

Advanced Custom Fields (ACF) Pro

Advanced Custom Fields (ACF) Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94. -

Gillion | Multi-Concept Blog/Magazine & Shop WordPress AMP Theme

Rated 4.60 out of 5

Gillion | Multi-Concept Blog/Magazine & Shop WordPress AMP Theme

Rated 4.60 out of 5$53.71Original price was: $53.71.$5.00Current price is: $5.00. -

Eidmart | Digital Marketplace WordPress Theme

Rated 4.70 out of 5

Eidmart | Digital Marketplace WordPress Theme

Rated 4.70 out of 5$53.71Original price was: $53.71.$5.00Current price is: $5.00. -

Phox - Hosting WordPress & WHMCS Theme

Rated 4.89 out of 5

Phox - Hosting WordPress & WHMCS Theme

Rated 4.89 out of 5$53.71Original price was: $53.71.$5.17Current price is: $5.17. -

Cuinare - Multivendor Restaurant WordPress Theme

Rated 4.14 out of 5

Cuinare - Multivendor Restaurant WordPress Theme

Rated 4.14 out of 5$53.71Original price was: $53.71.$5.17Current price is: $5.17.