Blog

Embracing Generative AI in Finance: A Strategic Partnership

The finance sector is undergoing a significant transformation driven by technological advancements. One of the most impactful developments is generative artificial intelligence (AI), which holds the potential to reshape various aspects of financial operations. Organizations that harness this technology can gain a competitive edge, enhance productivity, and improve decision-making processes.

Understanding Generative AI in Finance

Generative AI refers to algorithms that create new content, data, or solutions based on existing information. In finance, this can range from producing financial reports to generating predictive models that help in forecasting market trends. By effectively utilizing these capabilities, financial institutions can streamline processes, reduce operational costs, and ultimately enhance customer experiences.

Benefits of Generative AI in Financial Operations

1. Enhanced Data Analysis

In the financial realm, large datasets are commonplace. Generative AI enhances the ability to analyze these vast quantities of data by identifying patterns that may not be immediately visible to human analysts. This results in more insightful decision-making and supports the development of data-driven strategies.

2. Improved Risk Management

Risk assessment is a critical aspect of finance. Generative AI can help in creating simulations that predict potential financial risks based on various market conditions. By employing advanced modeling techniques, institutions can better prepare for market volatility and mitigate potential losses.

3. Personalization of Financial Services

With generative AI, financial institutions can tailor services to individual client needs. From personalized investment strategies to customized financial plans, AI can analyze client profiles and preferences, enabling firms to provide highly targeted services that enhance client satisfaction and loyalty.

Implementing Generative AI in Finance

Step 1: Assessing Organizational Needs

Before implementing generative AI, financial organizations must evaluate their specific needs and objectives. Identifying pain points and areas for improvement will help in developing a focused strategy that maximizes the potential of AI technologies.

Step 2: Selecting the Right Tools

Choosing the appropriate generative AI tools is crucial for success. Organizations should consider factors such as scalability, ease of integration with existing systems, and the ability to handle the volume of data inflow.

Step 3: Training and Development

To harness the full potential of generative AI, finance teams need to be well-versed in the technology. Providing training and development opportunities will enhance staff capabilities, facilitating a smoother transition to AI-enabled operations.

Challenges in Integrating Generative AI

While there are remarkable benefits to adopting generative AI, some challenges exist.

Data Privacy Concerns

Financial data is sensitive, and maintaining client confidentiality is paramount. Organizations must implement robust security measures to protect data and comply with regulatory standards.

Skill Gap

The rapid evolution of AI technology can lead to a skill gap in the workforce. Ongoing training and education initiatives are essential to ensure that employees can effectively utilize generative AI tools.

Ethical Considerations

There are ethical implications surrounding the use of AI in finance, including biases in algorithmic decisions. Organizations need to be transparent about their AI applications and continually assess their fairness and accuracy.

Case Studies: Successful Implementations

Case Study 1: Automated Reporting

A leading financial institution implemented generative AI to automate its financial reporting processes. The AI system generates detailed reports in real time, significantly reducing the time required for manual report generation and allowing analysts to focus on more strategic tasks.

Case Study 2: Fraud Detection

Another firm leveraged generative AI to develop a sophisticated fraud detection system. By analyzing transaction patterns, the AI could identify anomalies and potential fraudulent activities more quickly than traditional methods, thus enhancing security and protecting clients’ assets.

The Future of Generative AI in Finance

The potential of generative AI within the finance sector is immense. As technology continues to evolve, organizations that adapt and innovate through partnerships with AI will likely emerge as leaders in the industry.

Continuous Innovation

Ongoing research and development in generative AI will lead to even more advanced applications. Financial institutions that remain at the forefront of these advancements can gain a competitive advantage by continuously improving their services and operational efficiencies.

Regulatory Compliance

As generative AI becomes more integrated into financial processes, regulatory bodies are likely to establish guidelines to ensure ethical and fair usage. Organizations will need to stay informed and adapt to these regulations to maintain compliance and foster trust with their clients.

Conclusion

Partnering with generative AI represents a pivotal opportunity for financial institutions to enhance efficiencies, improve decision-making, and deliver personalized services. By understanding the capabilities, challenges, and future implications of this technology, organizations can strategically position themselves for success in an increasingly digital world. Embracing generative AI is not just a trend; it’s a necessity for those looking to thrive in the fast-evolving financial landscape.

Elementor Pro

In stock

PixelYourSite Pro

In stock

Rank Math Pro

In stock

Related posts

Build a Report Generator AI Agent with NVIDIA Nemotron on OpenRouter

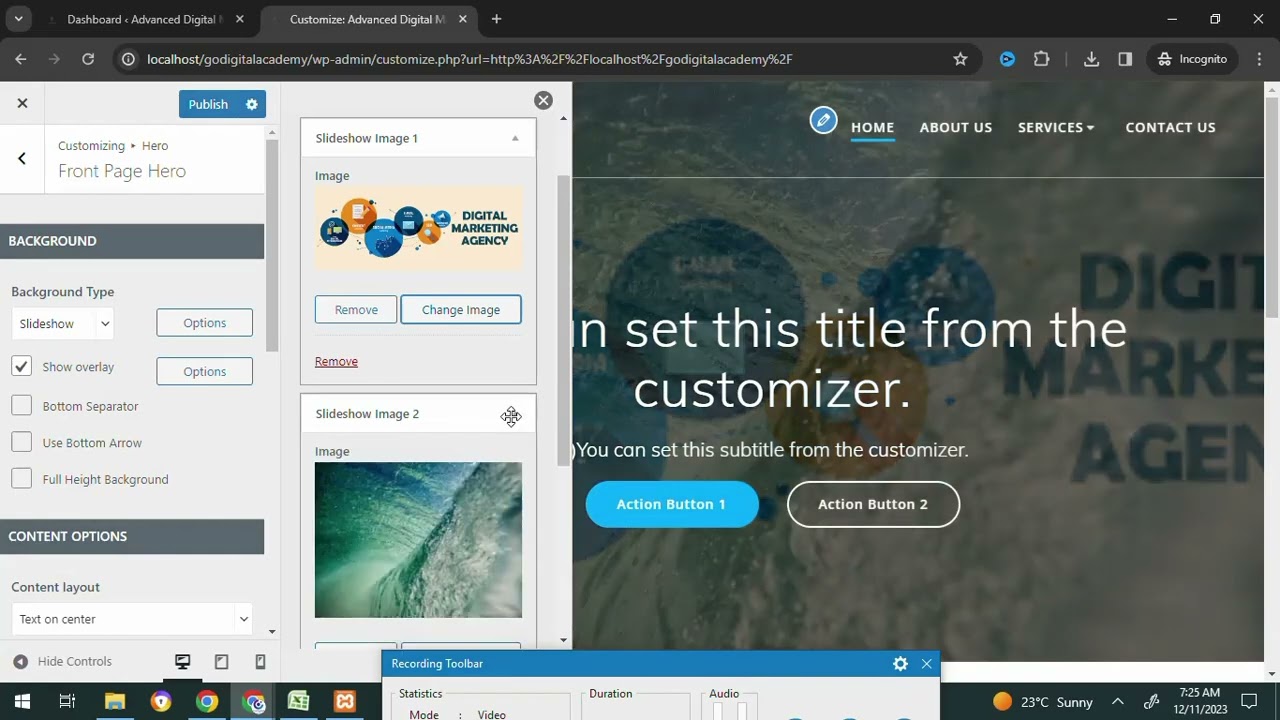

Word Press Day-3 How to add the Slideshow images and Top Bar and Editing the Home Page #godigital

Oracle Shares Surge 36% on AI Demand, Adding $244B Market Value

Top 5 AI Plugins That Will Change WordPress in 2025! 🚀 #websitesetup #websitedomain

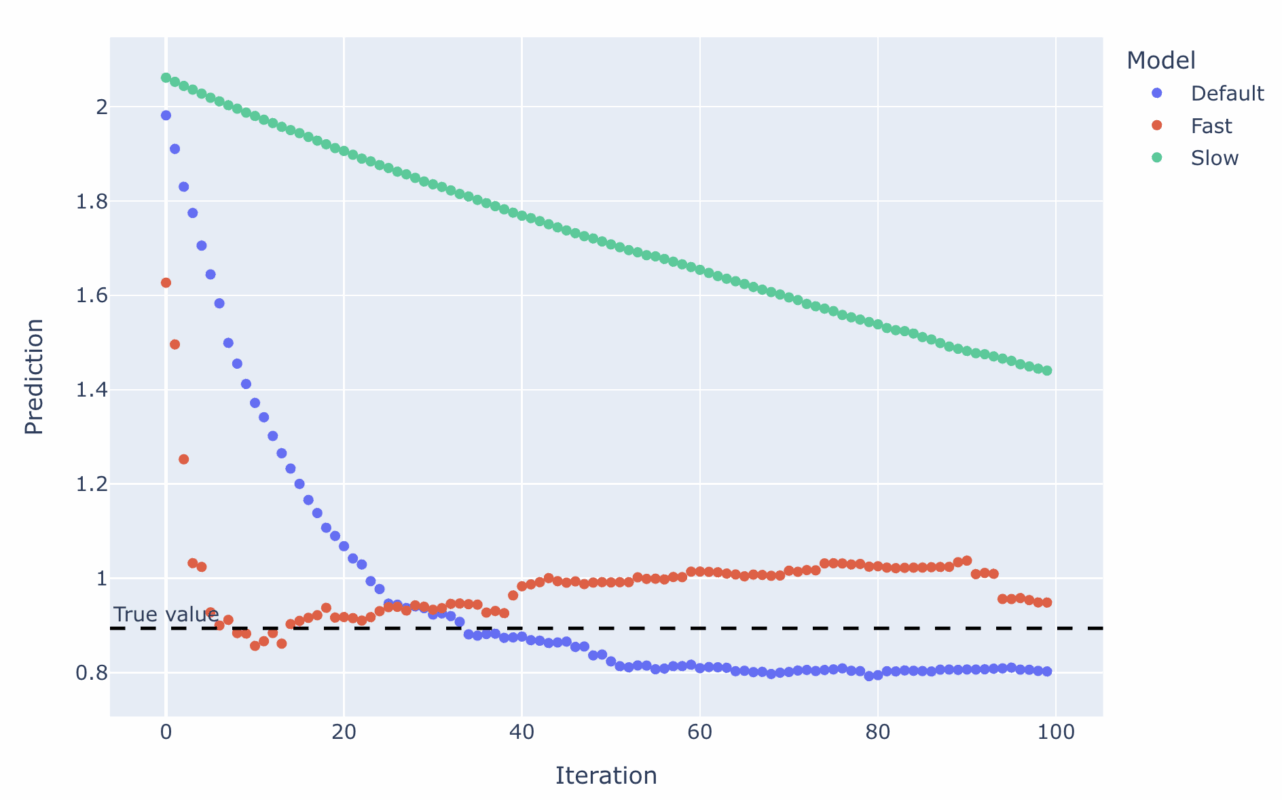

A Visual Guide to Tuning Gradient Boosted Trees

Here’s How I Built an MCP to Automate My Data Science Job

🔐Miss Genève 🌩️🌝🦅 ⚕️📿Wix and Word Press. Ads, Websites Developer. Marketers, Marketing experts,

AI Engine: o Melhor Plugin de Inteligência Artificial Grátis para WordPress – ChatGPT – OpenAI

AT&T Scales Back Office Surveillance After Employee Frustration

You Only Need 3 Things to Turn AI Experiments into AI Advantage

Gohighlevel’s mega menu feature breakdown in 3 minutes

Trump’s 2025 Bill Delivers $40B Boost to Fossil Fuel Industry

Products

-

Rayzi : Live streaming, PK Battel, Multi Live, Voice Chat Room, Beauty Filter with Admin Panel

Rayzi : Live streaming, PK Battel, Multi Live, Voice Chat Room, Beauty Filter with Admin Panel

$98.40Original price was: $98.40.$34.44Current price is: $34.44.In stock

-

Team Showcase – WordPress Plugin

Team Showcase – WordPress Plugin

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

ChatBot for WooCommerce – Retargeting, Exit Intent, Abandoned Cart, Facebook Live Chat – WoowBot

ChatBot for WooCommerce – Retargeting, Exit Intent, Abandoned Cart, Facebook Live Chat – WoowBot

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

FOX – Currency Switcher Professional for WooCommerce

FOX – Currency Switcher Professional for WooCommerce

$41.00Original price was: $41.00.$4.02Current price is: $4.02.In stock

-

WooCommerce Attach Me!

WooCommerce Attach Me!

$41.00Original price was: $41.00.$4.02Current price is: $4.02.In stock

-

Magic Post Thumbnail Pro

Magic Post Thumbnail Pro

$53.71Original price was: $53.71.$3.69Current price is: $3.69.In stock

-

Bus Ticket Booking with Seat Reservation PRO

Bus Ticket Booking with Seat Reservation PRO

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

GiveWP + Addons

GiveWP + Addons

$53.71Original price was: $53.71.$3.85Current price is: $3.85.In stock

-

ACF Views Pro

ACF Views Pro

$62.73Original price was: $62.73.$3.94Current price is: $3.94.In stock

-

Kadence Theme Pro

Kadence Theme Pro

$53.71Original price was: $53.71.$3.69Current price is: $3.69.In stock

-

LoginPress Pro

LoginPress Pro

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

ElementsKit – Addons for Elementor

ElementsKit – Addons for Elementor

$53.71Original price was: $53.71.$4.02Current price is: $4.02.In stock

-

CartBounty Pro – Save and recover abandoned carts for WooCommerce

CartBounty Pro – Save and recover abandoned carts for WooCommerce

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Checkout Field Editor and Manager for WooCommerce Pro

Checkout Field Editor and Manager for WooCommerce Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Social Auto Poster

Social Auto Poster

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Vitepos Pro

Vitepos Pro

$53.71Original price was: $53.71.$12.30Current price is: $12.30.In stock

-

Digits : WordPress Mobile Number Signup and Login

Digits : WordPress Mobile Number Signup and Login

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

JetEngine For Elementor

JetEngine For Elementor

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

BookingPress Pro – Appointment Booking plugin

BookingPress Pro – Appointment Booking plugin

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Polylang Pro

Polylang Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

All-in-One WP Migration Unlimited Extension

All-in-One WP Migration Unlimited Extension

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Slider Revolution Responsive WordPress Plugin

Slider Revolution Responsive WordPress Plugin

$53.71Original price was: $53.71.$4.51Current price is: $4.51.In stock

-

Advanced Custom Fields (ACF) Pro

Advanced Custom Fields (ACF) Pro

$53.71Original price was: $53.71.$3.94Current price is: $3.94.In stock

-

Gillion | Multi-Concept Blog/Magazine & Shop WordPress AMP Theme

Rated 4.60 out of 5

Gillion | Multi-Concept Blog/Magazine & Shop WordPress AMP Theme

Rated 4.60 out of 5$53.71Original price was: $53.71.$5.00Current price is: $5.00.In stock

-

Eidmart | Digital Marketplace WordPress Theme

Rated 4.70 out of 5

Eidmart | Digital Marketplace WordPress Theme

Rated 4.70 out of 5$53.71Original price was: $53.71.$5.00Current price is: $5.00.In stock

-

Phox - Hosting WordPress & WHMCS Theme

Rated 4.89 out of 5

Phox - Hosting WordPress & WHMCS Theme

Rated 4.89 out of 5$53.71Original price was: $53.71.$5.17Current price is: $5.17.In stock

-

Cuinare - Multivendor Restaurant WordPress Theme

Rated 4.14 out of 5

Cuinare - Multivendor Restaurant WordPress Theme

Rated 4.14 out of 5$53.71Original price was: $53.71.$5.17Current price is: $5.17.In stock

-

Eikra - Education WordPress Theme

Rated 4.60 out of 5

Eikra - Education WordPress Theme

Rated 4.60 out of 5$62.73Original price was: $62.73.$5.08Current price is: $5.08.In stock

-

Tripgo - Tour Booking WordPress Theme

Rated 5.00 out of 5

Tripgo - Tour Booking WordPress Theme

Rated 5.00 out of 5$53.71Original price was: $53.71.$4.76Current price is: $4.76.In stock

-

Subhan - Personal Portfolio/CV WordPress Theme

Rated 4.89 out of 5

Subhan - Personal Portfolio/CV WordPress Theme

Rated 4.89 out of 5$53.71Original price was: $53.71.$4.76Current price is: $4.76.In stock